But clicking on amending my return just says that the IRS is 'still preparing' the 'amends area'. You can follow any responses to this entry through the RSS 2.0 feed.īoth comments and pings are currently closed. Just as the title says, I need to amend my 1040X return after having e-filed digitally using the app TurboTax 2020. The IRS will then issue your refund as a paper check. If the institution can get the funds, it will return the refund to the IRS. In the case that the IRS already sent the payment, you will need to contact the financial institution.

This entry was posted on Thursday, September 2nd, 2021 at 7:43 am and is filed under IRS. Call the IRS toll-free at (800) 829-1040, any weekday between 7 a.m. I’m not going to quote five months when that simply isn’t happening. Bluntly, taxpayers should expect that it will take on average one year from the date they file their amended return for it to be processed. However, I do blame the IRS for misstating what taxpayers should expect from the IRS. As long as most government employees aren’t working in their offices, these delays will continue. Now, I am not blaming the IRS here for the delays. The last three amended returns I prepared for clients took nine months, 15 months, and 12 months to be processed. This year, however, the mostly likely reason your tax refund is delayed is that you filed a paper return.There was an additional backlog of tax returns created by the COVID-19 pandemic. changed your tax return The IRS is notifying you of delays in processing. Or maybe you claimed a credit that the IRS takes longer to check. I did my return through Turbo Tax and asked me to mail out the form once it was. I have seen an amended return processed that fast this year (back in March), but the return involved no change in dollar amounts (just changing the capital loss carryforward for a year). Or you accidentally skipped a lineor an entire form. Response: As a result of the backlog in the number of amended returns in inventory created by Coronavirus closures, the processing time has been extended to 20 weeks. One of the items asked in the “Hot Issue” questions was on amended returns: Additionally, the IRS periodically sends out “Hot Issue” summaries. Once the correct amount is calculated, the.

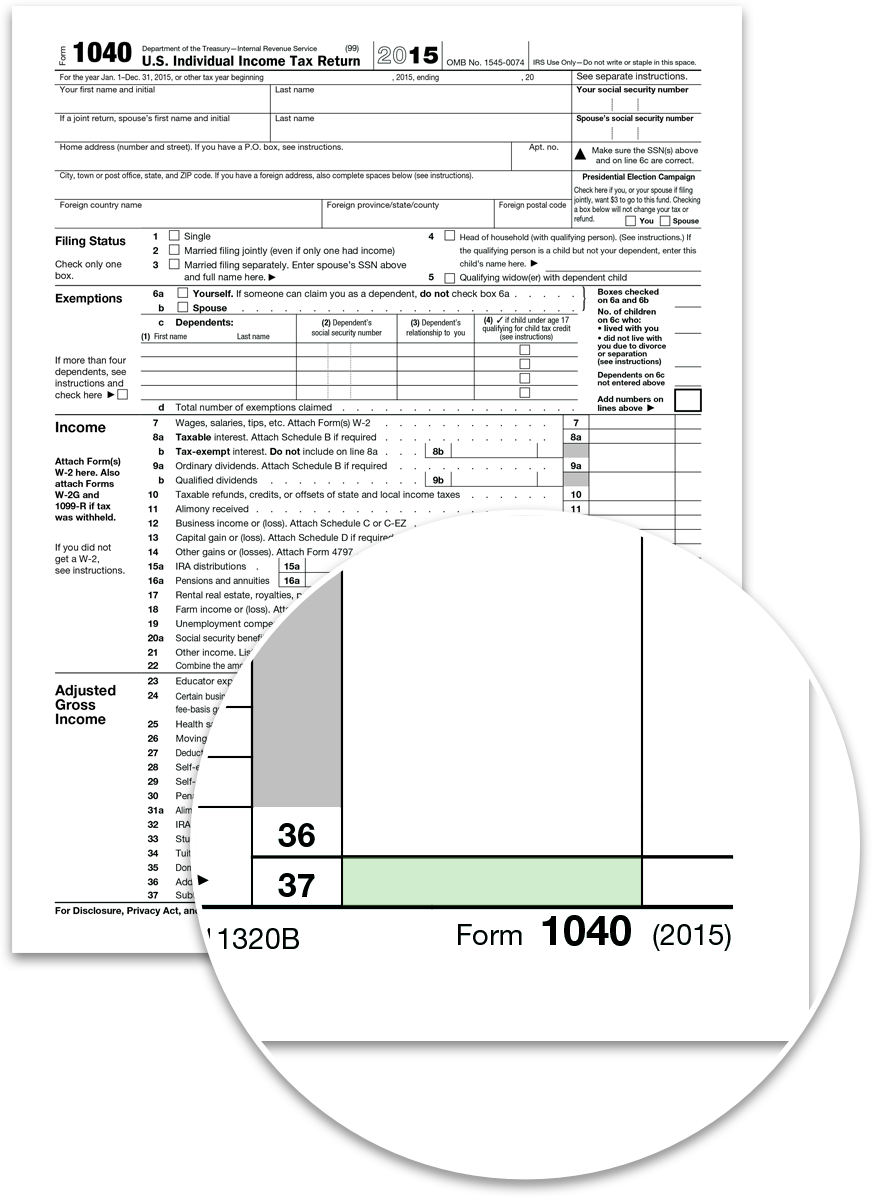

You will have to file an amended tax return using IRS Form 1040X. The IRS maintains a webpage showing operational status during the pandemic. The IRS will calculate the correct amount, if mistakes relating to the first and second stimulus payments are found on Line 30 of the 1040 or 1040-SR. TurboTax, TaxCut, TaxSlayer, TaxAct, etc.).

0 kommentar(er)

0 kommentar(er)